II. Economies of scale

II.1 Explaining the concept of economies of scale

Economies of scale are based upon decreasing unit costs. The reason for such decreasing unit costs is amount of output, driven notably by plant size. Bigger plants can produce more and are better at exploiting mass-production techniques. They can also specialize labor to specific, narrowly defined tasks. Bain (1956) distinguishes decreasing unit costs in production from those in distribution, with each one being susceptible to specific changes depending on (physical) output. 11

The central question around this concept is: Do unit costs change, depending on size? As higher output allows for greater specialization (impossible at smaller scales due to indivisibilities) and for bargaining power, such decreasing unit costs are plausible. These economies lead to a local minimum, i.e. the minimum efficient scale of a plant. At this point, a plant operates at the lowest unit costs for a given technology, or with the optimal degree of specialization of labour. If this minimum efficient scale is important compared to the total capacity of an industry, Bain regards these scales as significant. One important qualification needs to be made: When increasing output beyond the point of minimum effcicient scale, diseconomies with growing unit costs may result. The logical process of economies with increasing scale simply reverses itself.

Bain sees firms in industries adjust their size and the number of their plants to maximize their efficiency or minimize their cost per unit of production (Bain 1959, p. 146). Two assumptions are critical: (1) Firms are induced to seek maximal efficiency and (2) the degree of efficiency is systematically influenced by the size a firm attains. He distinguishes economies of scale due to large plants from those due to large firms (so-called economies of the multi-plant firm).

In another qualifier, Bain points out that his concept is not directly relevant to appraising the actual efficiency of a plant. This is due to volatility in output over time. Varying degrees in capacity utilization alter the relation of actual long-run average cost to scale: As larger scale operations realize their maximum efficiency under steady operations at planned capacity, market volatility may give advantage to smaller scale and more adaptable operations. As a consequence, market uncertainty may alter the actual optimal size of a plant.

Spence discusses how advertising expenditures interact with production costs to yield economies of scale. He sees advertising expenditures as fixed costs and asserts that "a certain amount of advertising is needed to counteract rivals' advertising, or to establish a market position..." (Spence 1980, p. 494). He argues that in an industry with differentiated products and advertising, it is the declining costs per dollar of revenues rather than declining production costs per unit of output that directly affect entry barriers and the profitability of established firms. Because advertising is designed to influence demand and therefore prices, it cannot be discussed entirely in terms of economies of scale or cost advantages in the normal sense. As demand and prices are affected by advertising, the relevant measure of scale economies, according to Spence, is to be found in the relation between the firm's revenues and its costs per dollar of revenue, rather than in the relation between costs and output as measured in physical units. With his model, he conceives a production function with revenues as output, and the inputs being the product in physical units and advertising expenditures. If this production function is characterized by increasing returns to scale, then a firm's cost per dollar of revenue generated will decline with growth in market share. It is quite possible to have diminishing returns to advertising alone, limited (or no) production economies, and considerable inherent differentiation, and still have overall economies of scale in the relevant sense. Just as in production theory, he sees that it is the sum of the response elasticities to the inputs that determines the extent of the returns to scale.

II.2 A model for limit pricing (Bain-Sylos-Modigliani)

It is important to note that not only may economies of scale explain superior margins due to superior efficiencies in production, they may also work as deterrents to entry.

The Bain-Sylos-Modigliani model of limit pricing depicts such deterrence (Tirole 1997, Sylos-Labini 1962): Economies of scale induce the incumbent to maintain output at the minimum efficient scale as the optimal reaction to new entry. High output around the minimum efficient scale of a firm allows for unit cost advantages compared with (smaller scale) entrants. These cost advantages act, of course, as a deterrent to smaller scale entrants (Bain 1956, p. 107).

The dominant firm produces at output Xi which the entrant expects to be maintained by the incumbent if entry occurs. This implies that the entrant will face a residual demand curve, which is shifted to the right by the amount actually produced by the incumbent. The entrant cannot profitably enter, given the incumbent's output and his expectations that the incumbent will maintain this output even after entry: The market price PL is below the entrant's average cost at output Y, and there is no feasible level of output for the entrant where his average cost curve actually intersects with his residual demand curve. As a consequence for price policy, he concludes: The larger the percentage of the minimum efficient scale to total market capacity, and the more steeply unit costs decrease with changes to scale, the more long-run prices can be elevated above the least cost level without inducing entry.

Bain's proposition was intuitively appealing in its original formulation, but it evoked a good deal of confusion about the expectations of potential entrants. Modigliani (1958) suggests that a useful assumption is that potential entrants expect existing firms to maintain their pre-entry output after entry occurs. If the entrants hold such expectations, then limit pricing deters entry since entrants would expect the post- entry price to be below their average cost. However, such expectations are irrational. Any potential entrant that did enter such an industry could immediately drive industry price below all firms' average costs since there are no entry or adjustment costs in these models. The more inelastic the demand, the stronger the dynamic, i.e. small additional outputs will drive prices down quickly. The existing firms would then incur losses by maintaining their outputs while, whereas if they had decreased their outputs, they could have earned profits (Flaherty 1980, p. 160).

Flaherty's model lets a firm enter an established industry if and only if the potential entrant expects to be able to earn profits during the post-entry competition. The established firm's pre-entry output level is such that the entrant would have average unit costs exceeding market prices for a range of output rates between zero and some positive level of output. If the entrant were to increase capacity slowly, he would experience a period of negative cash flow before entering a period of positive cash flow. By purchasing a large plant, the entrant would shorten the duration of his negative profit period and thus increase his net present value. This means that the entrant would then be able to operate at the same minimum efficient scale as the incumbent, and there would be no point in maintaining output at pre-entry levels.

Flaherty agrees with Bain in that greater increasing returns to scale will enable an incumbent to deter entry more effectively. With steeper slopes in the AC-curve, an incumbent firm could still deter entry, even by lowering its output. This would enable the dominant firm to maximize profits (by keeping prices high) while still deterring entry. For the entrant, this means that entry at large output levels (around minimum efficient scale) could be more advantageous than entry at small levels, although this is conditional on the slopes of the AC-curve.

Scherer and Ross show that entrants who choose to enter at minimum efficient scale will depress the price, depending on the minimum efficient scale relative to the overall size of the market (other things, such as elasticity of demand, being equal). In an example, they assume unit elasticity and an minimum efficient scale of 10% of total quantity demanded. Then, as a consequence of entry at MES, prices will be depressed by 10%. Unless the pre-entry price exceeds the potential entrant's expected unit costs by more than 11%, entry will be unprofitable. In comparison, with a minimum efficient scale of 5%, existing firms can hold their price no higher than 5.25% above minimum unit cost without encouraging entry. In general, the smaller the minimum efficient scale is relative to the output volume demanded at a price equal to minimum unit cost, the less price can be held persistently above the competitive level without attracting new entry, ceteris paribus 12 (Scherer and Ross 1990, p. 378).

This statement must be relevant for empirical observations: Only with steep falls in unit costs in the airline business and with significant minimum efficient scale, can economies of scale be found to matter for holding prices persistently above competitive levels.

II.3 Are there economies of scale in the airline sector?

After the deregulation of the US airline market in 1978, the question whether or not this industry showed economies of scale was discussed in several economic papers, most of them examining the US context. The question was initially less relevant for new entrants, who might have been concerned about minimum efficient scale to be attained in order to be competitive with the incumbents. In reality, the economies-of-scale-argument was more often used by representatives from the major airlines when discussing route extensions and merger activities with the federal authorities.

II.3.1 General cost drivers in the industry

Before examining some prominent economies in the industry in detail, I would like to provide a more general overview over the cost structure of the industry. This helps to situate possible economies of scale within the big picture of total costs of the industry or firm. In line with the remark already made by Spence on the role of advertising and economies of scale, I would like to show the possibility that within an industry or firm there are likely to be different sources for increasing returns to scale, which need not be aligned at all times. The introduction of several potentially important cost drivers in the industry will help to indicate such possible increasing returns, which may then be examined further on. This section will in large part be based on "An empirical study of cost drivers in the US airline industry" by Banker and Johnston (1993). The authors distinguish cost drivers that are volume based from those that are operations based. This distinction is noteworthy, seeing economies of scale (in the tradition of Bain, Spence et al.) as typically volume-based returns. Apparently, operations can also have significant influence on the firm's unit costs. Indeed, while Bain saw plant size as the key for achieving economies, operations can just as well lower unit costs to an extent that any new entrant who cannot employ the same operations without a cost will face a cost disadvantage.

The following operations-based drivers represent choices of alternative technologies, as such choices of aircraft models, route structures, flight frequency or density, and traffic flow control. These drivers need to be regarded separately from scale-based drivers, which are based on the number of passengers transported or on the capacity of seat miles offered.

When the examined cost drivers showed either increasing or decreasing returns, marginal costs would also change with these operations-based drivers. 13

| Input category and measurement units | Volume based drivers | Operations based drivers |

| Fuel in gallons | Capacity seat miles by aircraft type (+) |

Average stage length (-) |

| Flying operations, labour hours | Capacity seat miles by aircraft type (+) |

Density (-) Hub concentration (-) Hub domination (-) |

| Passenger service, labour hours | Capacity seat miles by aircraft type (+) |

Density (-) Hub concentration (-) Hub domination (-) |

| Maintenance, labour hours | Capacity seat miles by aircraft type (+) |

Density (-) Hub concentration (-) Hub domination (-) Scale (+) |

| Maintenance materials and overhead, deflated costs | Capacity seat miles by aircraft type (+) |

Density (+) Hub concentration (-) Hub domination (-) |

| Aircraft and traffic servicing, labour hours | Passengers (+) | Density (+) Hub concentration (-) Hub domination (-) |

| Promotions and sales, labour hours | Passengers (+) | Density (+) Hub concentration (-) Hub domination (-) |

| General overhead, deflated costs | Total capacity seat miles (+) | Density (+) Hub concentration (-) Hub domination (-) Scale (+) |

| Group property and equipment, deflated costs | Total capacity seat miles (+) | Density (-) Hub concentration (+) Hub domination (+) Scale (+) |

- The results for competitive and dominated hubs show large, significantly negative coefficients for labour that handles passengers, cargo and aircraft on the ground. Ground property and equipment and labour for flying operations are also significantly negative, and those for general overhead are significantly positive. Thus, by adopting a hub and spoke strategy, a carrier can achieve fairly substantial economies in the use of most inputs.

- The coefficient estimate for average stage length is significantly negative for the fuel cost category. This lends support to the hypothesis that the marginal requirements for fuel inputs diminish as average stage length increases.

- For promotions and sales labour, the coefficient for density is significantly positive, which indicates that adding flights on a given network requires additional support labour. The coefficient for passenger service labour is significantly negative. The coefficients for flying operations labour, maintenance labour, maintenance materials and overhead are insignificant. There are inherent difficulties in measuring capital inputs.

- Comparisons among older aircraft, notably between larger and smaller planes, indicated highly significant differences in coefficients and are consistent with the hypothesis and industry evidence that wide-bodied aircraft require less fuel and flying operations input than older regular-bodied aircraft. However, sharp differences between older large aircraft and newer, slightly smaller models are not indicated. This suggests that the improvements in fuel efficiency and reductions in required crew size for the newer models have made up for the size-based advantages larger aircraft had in the past.

II.3.2 Economies of scale versus density

II.3.2.1 Defining the differences

The question needs to be addressed of what is actually meant by "scale" in the airline industry. As we have seen, Banker and Johnston regard the number of passengers and capacity seat miles as scale, whereas density is an operations-driven variable.

In a cost and factor productivity analysis of European flag carriers, Encaoua (1991) measures output in three ways: (1) Number of passengers, (2) Revenue-passenger kilometers (RPK), and available-ton kilometers (ATK). He sees an airline's scale dimension as mainly driven by stage length and traffic density. His proxy for density is simply the airline's load factor (RPK/ATK) on European routes compared to the North Atlantic ones. Scale to him is simply measured by the output measures number of passengers and revenue-passenger kilometers, while density depends completely on the average degree to which an airline loads its entire fleet for all European destinations compared with all North Atlantic routes. Unlike the other authors, Encaoua completely ignores factors such as network characteristics or technological arguments such as the relative efficiency of different aircraft sizes. He is interested more apparently in different factor costs within Europe and the factor productivity associated with them. By definition, whenever an airline achieves a higher load factor than competitors, ceteris paribus, output must have gone up as well. The extent to which a higher density will result in increasing, decreasing or constant returns can hardly be shown on such an aggregated basis.

Other authors focus on technological aspects (such as aircraft size) or network characteristics (average departures per airport or hub-and-spoke service) to correlate their definitions of density with the slope of returns, while keeping average stage length and average load factor constant. Kirby (1986) measures an airline's output (as a scale dimension) in ton-miles-performed (TMP). He defines an identity relationship between TMP and five factors:

TMP = PORTS * ADPP * ASL * AAS * ALF 15

It is important to note that Kirby employs variables - notably ADPP - that were already understood by Banker and Johnston to describe market density. Before Kirby, it was Caves, Christensen and Tretheway (1984), who showed that differences in scale per se have no role in explaining higher costs for small airlines. In order to make this clear, they distinguish in their model between returns to scale and what they call returns to density. To do so, they include two dimensions of airline size: the size of each carrier's service network and the magnitude of passenger and freight transportation services provided. They make this distinction between level of output and firm size, since "one might expect a lower level of unit costs if a given output were provided over a smaller number of cities" (p. 473). With returns to scale being accounted for separately from returns to density, definitions become somewhat more precise: Economies of density exist if unit costs decline as airlines add flights or seats on existing flights (through larger aircraft or denser seating configuration), with no change in average load factor, average stage length, or the number of airports served. 16 Scale economies exist if unit costs decline when an airline adds flights to an airport that it has not been serving and the additional flights cause no change in average load factor, average stage length or output per airport served (density). 17

II.3.2.2 Introducing hubs and spokes

In contrast to point-to-point routing, hub-and-spoke service allows airlines to concentrate traffic on key airports and to feed in from low-traffic airports. With the above framework in mind, the significance of hubbing now becomes clear: Hubbing allows smaller airports to be served with short-haul, smaller aircraft. Flight frequencies between airport legs can thus economically be increased; by definition, they need to be increased as passengers change at airport hubs instead of flying direct (variable ADPP goes up with hubbing). As a higher percentage of traffic is funnelled through key airports, connections between hubs may economically use larger wide-bodied, long-haul aircraft, which on other routes might not encounter the steady high demand required for economic service (variable AAS). We see that hubbing may be highly instrumental in increasing dense air traffic.

Bailey, Graham and Kaplan (1991) focus on hub-and-spoke operations as the new network characteristics after deregulation in the US. They argue that such operations increase the average number of passengers per flight, letting the carrier take advantage of the economies of scale in bigger aircraft. Brueckner, Dyer and Spiller (1992) see the hub-and-spoke characteristics of an airline network as the basis for economies of density. Given such a hub-and-spoke network, network size (the number of city origins and destinations) and the size of the connected cities will increase density within such a system. By funnelling all passengers into a hub, such a system generates high traffic densities on its "spoke" routes. In another paper, Brueckner and Spiller (1994) understand the growth of networks to be an attempt to exploit economies of traffic density, under which the marginal cost of carrying an extra passenger on a non-stop route falls as traffic on the route rises (p. 380). In other words, network size as a scale dimension matters for density, but it is the hub-and-spoke characteristic that makes a given network size more densely employed.

In contrast to the Caves, Christensen and Tretheway approach, Brueckner and Spiller consider details within the hub-and-spoke system that critically affect density levels. They quote the example that by holding the number of endpoints fixed, densities would fall as the number of hubs operated by the airlines increased, a network characteristic that was not accounted for by the Caves et al. model. The complex interdependence between scale and density in a hub-and-spoke network becomes clear in one of the paper's main conclusions: Entry into a particular city pair market (increasing scale) will usually be a network-wide decision (because it impacts on density in different spokes), rather than a decision based on the characteristics of the individual market (the city pair). This higher density then can be exploited by higher load factors or bigger, more efficient aircraft. Within a hub-and-spoke context, the researched economies of density were referred to as economies of spoke density (Berry, Carnall and Spiller 1996). 18 The exogenous variables of this model include distance between the endpoint cities and characteristics of the origin and destination airports. In this model, which does not account for the fixed cost effects of hubbing, only use of marginal costs is made.

II.3.2.3 What brings down unit costs?

Caves, Christensen and Tretheway (1984) develop a model of costs for airline services, with the intention of exploring the "apparent paradox of small air carriers with a purported unit cost disadvantage competing successfully against the large trunk carriers" (p. 472). The apparent contradiction regarding the trunk/local cost differential is explained by differences in the network characteristics between trunks and local service carriers. The average number of cities served by the locals is virtually the same as that of the trunks, but the density of traffic is much lower. The authors conclude that for both trunk and local carriers it is impossible to reject the hypothesis of constant returns to scale, but that the hypothesis of constant returns to density has to be rejected at each of the points observed (p. 479). They explain cost differences by the respective density of traffic within an airline's network. The average length of individual flights is also considered important. They grossly explain casually observed differences in unit costs for trunk airlines (7.7 cents per passenger mile in 1978) and for locals (11.2 cents) by lower density of service and shorter stage length for the locals (p. 483).

Encaoua (1991) finds unit costs per passenger kilometrs to be lower on North Atlantic routes than on European ones. According to him, this result reflects the economies of scale due to greater distances and traffic density on North Atlantic routes. He measures unit costs, unit revenue, average distance and load factors computed for European and North Atlantic routes. The main reason for the lower unit costs on the North Atlantic routes (costs per available ton kilometre in Europe are two to three times those on North Atlantic routes) is seen as being linked to distance (p. 115). However, in 1986 unit costs also varied within European routes in a spread greater than 40% in 1986. The difference in average distance between carriers in Europe was not sufficient to explain such a difference. Variations in factor prices and factor productivity were considered part of the explanation. It was shown that the average load factor is categorically higher on North Atlantic routes than on European ones (p. 116). He sees this as a clear indication that density of traffic is more important outside Europe than inside Europe. For this reason, he argues, the most dynamic European carriers try to increase the size of their North Atlantic network despite the fact that competition on these routes is more severe. All his observations confirm that geographical and network configurations are sources of substantive variations in unit costs (and unit revenues) between European carriers.

Brueckner, Dyer and Spiller (1992, p. 309) relate the fare paid by a four segment passenger, whose trip requires a change of planes at a hub airport, to the characteristics of the network in which he travels. With market specific variables, distance was found to be highly significant for lower fares (p. 325). The authors conclude that there is evidence for the importance of hub-and-spoke networks in reducing airline costs. In another paper, Brueckner and Spiller (1994, pp. 379) find that economies of density are strong during the sample period, even stronger than previous estimates by Caves et al., which were derived from traditional cost function methods. In their model, they determine the level of competition jointly along with fares. Their estimates of the desired cost functions are based on a structural model of airline behaviour. Brueckner and Spiller show that in 1985 the marginal cost of carrying an extra passenger in a high density network was 13%-25% below the cost in a medium or low density network, giving the high density carrier a distinct competitive advantage. It was shown that fares in a city pair market are low when traffic densities on the spokes connecting the market cities are high. It was also shown that longer trips had higher fares. Fares were also lower in markets with high tourism potential. As a main result, the elasticity of marginal cost with respect to spoke traffic was computed: Marginal cost falls by about 3.75% for every 10% increase in spoke traffic. This effect is stronger than the one estimated by Caves et al., which would correspond to a fall in marginal cost of about 2%. Brueckner and Spiller see the density effect as a causal factor leading to the emergence of dominated hubs. 19

They go on to explain that cost efficiencies of hubs may arise from the use of large, cost-effective aircraft on the densely trafficked spokes of a hub-and-spoke system. This relies in part on an engineering argument that larger planes are cheaper to fly regarding unit costs, at least on longer routes. For a given flight frequency, dense spokes can efficiently use larger aircraft. Economies of scale at the level of airline spokes in turn imply network economies, since hubbing airlines can combine passengers with different final destinations on a single large plane that flies to a hub city. At that hub the passengers switch to different planes, which carry passengers from various initial origins (Brueckner, Dyer and Spiller 1992).

We have seen that Kirby (1986) finds substantial economies of operation with respect to load factors, aircraft size and stage length. In contrast, his model suggests diseconomies when an airline serves more ports and when it operates more flights from a given port. He assumes that such increasing costs related to market density probably arise from airside congestion at busier airports and congestion within the airport facilities. Kirby infers from this that cost advantages from dense markets "result largely from the ability to operate large aircraft at relatively high load factors, rather than merely from the opportunity to make more flights". 20 He goes on to forecast the impacts of different policies on total airline operating costs. In particular, halving the number of departures and doubling the size of the aircraft is estimated to lower operating costs most significantly (by 17.4% over a three year period).

Depending on demand conditions, airlines may respond to increased density by increasing flight frequency rather than by increasing plane size (Berry, Crandall and Spiller 1996, p. 5). In their results, these authors find that congestion appears to raise segment marginal cost. According to their model, at distances less than 500 miles, marginal cost increases as density increases up to about 150,000 passengers per quarter and then begins to decline. At shorter distances this effect of finally decreasing marginal costs may not be seen, since the increased cruising efficiency of larger aircraft may not make up for their higher take-off and landing costs over these shorter distances. Increases in density in such cases would need to met with increases in frequency.

Their model of airline competition captures two major features of the industry: product differentiation and economies of density. On the cost side, their paper presents evidence of economies of density on longer routes. However, economies of density may depend on the nature of the route. In particular, economies of density at distances less than 500 miles were not found. Consistent with the "Southwest Airlines effect", there was no evidence found concerning economies of density on shorter routes. According to these estimates, the "Southwest effect" may not be exclusively the result of lower labour costs, but rather may be the result of Southwest's having found a particularly effective cost niche.

II.3.3 Tracing cost curves for the airline industry

The above graphical depiction provides a somewhat broad map of the relationships in the hub-density-aircraft complex. The signs (positive or negative) depict the expected relationships that empirical studies have found on marginal and average costs. In this section, I am trying to find a specific operations-based cost curve for the airline industry, which allows discussion of the trade-offs between increasing and decreasing returns and - it is hoped - identification of the shape of "minimum efficient density" in analogy to Bain's minimum efficient scale.

As I have already pointed out, Caves, Christensen and Tretheway (1984) define returns to density as declining unit costs, with increasing numbers of passengers being transported between two points without any change in load factor occurring. Their parameters for declining unit costs (as well as marginal costs) are frequency of flights and size of aircraft (I chose to neglect the option of adding more seats to existing airplanes). Casually observed differences in unit costs for trunk airlines and for locals are largely explained by differences in characteristics of the firms, particularly by lower density of service and shorter stage lengths for the locals (p. 483). Thus, the following cost curve can be drawn:

Encaoua (1991) identifies higher density solely with a higher load factor. He admits that the average load factor's impact on increasing, decreasing, or constant returns can hardly be shown on such an aggregated basis of overall airline operations. To him, what he calls geographical and network configurations are the source of variations in unit costs. He judges the aircraft type to be less relevant for such variations than average stage length. This statement per se does not contradict the above graph, though it lessens the significance of aircraft type for unit costs.

Bailey, Graham and Kaplan (1991) focus on the returns of hub-and-spoke operations. Operating hub-and-spoke networks combines passengers with different origins and destinations - increasing the average number of passengers per flight and thereby reducing costs. Essentially the broader scope of operation lets the carrier take advantage of the economies of scale in aircraft (p. 74). The hubbing carrier would serve more passengers on its flights so it could use larger aircraft and/or higher load factors. This indeed is a classical argument of economies of scale: Larger, more efficient aircraft may offer lower unit cost if their capacity is sufficiently employed, just as a larger production plant may produce at lower average unit costs if its production volume is sufficiently close to its minimum efficient scale. This is highly relevant, because if Bailey et al. are right, then the key parameters of density would be nothing but simple economies of scale, similar in nature to Bain's concept of specialization. By funnelling traffic through a hub, hubs and spokes are instrumental in the exploitation of these economies of scale. Density together with hubs are a prerequisite for obtaining the minimum efficient scale, but would not be the origin of decreasing unit costs. Brueckner and Spiller (1994) build on this understanding of the density impacts of hubbing. They focus their research on marginal cost decreases when traffic on traffic spokes increases. They understand the growth of hub-and-spoke networks as an attempt to exploit economies of traffic density, according to which the marginal cost of carrying an extra passenger on a non-stop route falls as traffic on the route rises (p. 380). It is important to note that although they do not take into account the varying degrees of aircraft efficiency or load factors actually achieved, they nevertheless acknowledge their importance: " This higher density then can be exploited, analogously to Bailey, Graham and Kaplan (1991) by higher load factors or bigger, more efficient aircraft.

If we understand hubbing and increased density as the means for exploiting economies of bigger and more efficient aircraft later on, then the marginal cost elasticities empirically tested by Brueckner and Spiller can be analogously applied not only to density on spokes but also to the associated parameters of aircraft type and average load factor. The following graph depicts this relationship:

As a result, marginal cost falls by about 3.75% for every 10% increase in spoke traffic. The effect is stronger than the estimates by Caves, Christensen and Tretheway which would correspond to a fall in marginal cost of about 2%.

In a follow-up study, Berry, Carnall and Spiller (1996) find no economies of density on shorter routes (less than 500 miles). In their model's specification, there are common costs across products because the same spoke can enter into the production of many demand side products. According to Banker and Johnston (1993), savings in marginal cost (av.$27) derive largely from concentrating flights through hubs. The savings associated with increasing average stage length are smaller (av.$2 per 1,000 capacity seat miles) and those associated with increasing density are the smallest (av.$1 per 1,000 capacity seat miles). Approximately 38% of the observations, however, exhibit net increases in costs with increases in density. The estimated net savings associated with all operations-based drivers average $33 and range from $10 to $132 per 1,000 capacity seat miles. If we were to aggregate effects in hubbing with those in density, decreasing marginal costs would seem to be confirmed.

The question remains about the ambivalent effect of average stage length on average unit and occasionally observed increases in marginal costs. It is well documented that within the range of each aircraft, unit costs generally decrease with distance (Encaoua, Geroski and Jacquemin 1986), largely due to the character of planes as fixed costs and also due to the fixed cost character of take-off and landing fees. Banker and Johnston (1993) find this impact small, albeit favourable, when compared with the hubbing-density complex. Brueckner and Spiller (1994) even find increasing marginal cost with distance, according to their formula. 21 Decreasing marginal costs even at high densities could also not be found at short distances (Berry, Carnall and Spiller 1996). We conclude from this that the contribution of distance on decreasing marginal costs is small, and even strongly negative at distances below 500 miles, since it suffices to compensate otherwise strong economies of spoke density. This may also explain why Brueckner and Spiller had found a positive and slightly increasing relationship between overall marginal cost and the average distance in their sample.

In order to find one general cost function for the airline sector, the counteracting slopes between density (aircraft, average load factor) and average stage length would need to be balanced and synthesized into one marginal cost curve. This can only be done by introducing a third axis (dimension) into our graph (for a three-dimensional graph, see Berry, Carnall and Spiller 1996, p. 41). Here, we choose to represent three marginal cost curves, each representing another stage length, in order to keep our cost curves in two dimensions. This representation also proved to correspond to the empirical values of table "Derivative of marginal cost with respect to density" 22 (p. 38).

On the other side, costs that remain unaffected by a change of aircraft type are greater than those that depend on the type of aircraft (Encaoua 1991). Encaoua regards average load factor the key driver for increasing returns to scale, to be more important than average aircraft size. Beyond the obvious trade-off of either choosing a larger, more efficient plane or keeping a smaller one and increasing its load factor, other economies "ex aircraft" are identified. The fact that such other costs could represent a larger part than aircraft-based costs would not matter if their returns were constant. At this point, it may be helpful to go back to Banker and Johnston's (1993) empirical analysis of cost drivers. Now we are only interested in cost drivers for indirect airline costs, which are not determined by aircraft type. From their table with the hypothesized cost driver relationships, we retain the following:

The results for the four categories above show significantly increasing returns to scale with respect to hubbing. These returns were even stronger when an airline dominated an hub. Levine (1987, p. 473) sees hubs as a means of reducing the time during which traffic builds to long-term levels, thus reducing the firm-specific non- recoverable entry costs (this would not affect marginal cost). He sees these and other lower incremental costs from hub operations as close to zero. Apparently, hubbing exhibits additional economies of scale, probably due to (organizational) centralization effects, which are independent of aircraft economies of scale. Congestion effects may be the most likely constraints to these increasing returns (Kirby 1986). These economies of scale due to centralization may be more pertinent than the possible efficiencies of density and bigger aircraft.

Only by accounting for both effects - economies due to aircraft and due to hubbing - can one general average unit cost curve be found, which represents the minimum efficient scale for all major cost functions of an airline business. A clear understanding of which parts of density and hubbing are reflected in aircraft economies of scale and which in centralisation economies is key for the following integration of both effects. In short, an airline would tend towards its own minimum efficient scale by trying to organize hub-and-spoke operations and trying to dominate them, though avoiding congestion at the airport. At the same time, it would choose the most efficient aircraft to handle the increased traffic, probably wide-bodied long-haul carriers, to direct them at high load factors to other hubs for maximum economic gain.

The above graph suggests the combined impact of economies of scale with wide-bodied, more efficient aircraft and economies of scale due to hub dominance. We assume more efficient, wide-bodied jets to be more expensive to buy than smaller ones. That's why AC2 is initially higher than AC1. At a higher load factor, the new aircraft's efficiency starts to show, where average unit costs become smaller compared with a narrow-bodied plane. However, the big plane's minimum efficient scale is achieved at higher capacity seat miles than with the small one. That is, a hub has to funnel consistently more passengers towards bigger planes serving its spokes in order to achieve its minimum efficient scale (or even to undercut average unit costs of smaller planes). With the risk of over-concentration at hubs, the risk of traffic congestion rises. In the case of traffic congestion, we assume marginal costs for bigger planes to be significantly above those for smaller ones. This explains why the slopes at high centralization of traffic at hubs are steeper for bigger, albeit efficient, planes. We expect the shape of average cost lines to hold for distances between 600 and 1,500 miles approximately, following empirical tests by Berry, Carnall and Spiller (1996). With greater distances, the differences between low and high density are probably more important. Below 600 miles, however, we expect both AC1 and AC2 to flatten out significantly.

II.3.4 Economies on European routes

We are interested in locating European airlines on these depicted cost curves. In particular, we will try to determine if certain airlines appear to be operating closer to their minimum efficient scale than others. In order to do so, we need to look at the average stage length for city pairs of European carriers and at their respective flight concentration from and to their hub airports. The latter is a strong indicator for density, in the sense of having the opportunity to employ larger aircraft with higher load factors, and also indicating the potential to centralize operations at the hub.

II.3.4.1 Stage lengths of European routes

The distance between European city pairs is known to be significantly shorter than, for example, most US routes.

Note: In air transportation, the use of nautical miles (1,852 meters) is common.

A first look at the distances within Europe is already revealing. Three broad categories of city pair distances can be distinguished:

- Distances below 500 miles

Here, marginal costs are expected to increase (with density) and average costs are relatively high. Five out of fifteen city pairs of Exhibit 14 fall into this category.

- Distances greater than 500 miles, but less than 1,500 miles

Here, we expect constant or slightly decreasing marginal costs with increasing density and average costs to be located on a cost curve that is lower than the first category even though its slope is rather flat. Seven out of the fifteen routes in the table correspond to this category.

- Distances above 1,500 miles

Only under these conditions can we expect marginal costs to decrease significantly with density and average costs to lie on a cost curve that obtains the lowest unit costs of all shown cost curves, provided that a critical degree of density (or hub concentration) is achieved. Only at average stage length above 1,500 miles would we expect relatively steep slopes for the convex average cost curve. Only here would we expect a distinct minimum efficient scale to be identified. Three out of fifteen city pairs in the table above fulfil these requisites.

It has to be noted that only peripheral European routes, such as Madrid-Athens, Athens-London or Stockholm-Madrid, constitute such stage lengths. These routes traditionally have never been the most densely travelled ones in Europe. So, even if we expect such routes to be situated on lower average cost curves, these routes do not constitute the bulk of the airlines' network structure. They are the exception rather than the rule. In addition, density on such routes has traditionally not been the highest in Europe.

This situation changes if the intercontinental routes of some European airlines are included in the picture. With average stage lengths to the US about nine times the typical stage lengths within Europe, carriers with such long-distance connections apparently have significantly lower unit costs with regard to their whole network than competitors who are constrained to purely European markets. This has been pointed out by Encaoua before. Only a few entrants in Europe offer such intercontinental connections, including Lauda Air and Virgin Atlantic.

II.3.4.2 Hub concentration at the origin or destination airport

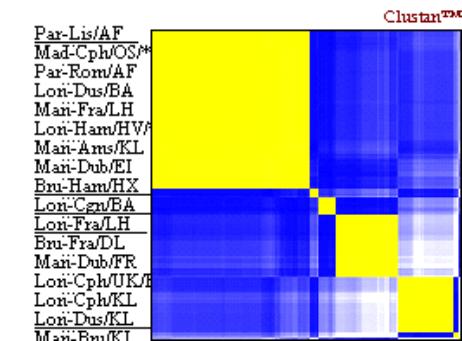

In order to account for both economies of scale stemming from larger aircraft (and higher load factors) and economies of scale from concentrating operations at a hub, we use the amount of capacity seat miles an airline generates from its principal airport as a suitable parameter to describe both potential economies. From different statistics, we can infer that only a few European airlines do indeed have such elevated numbers: British Airways at Heathrow, Lufthansa at Frankfurt and Air France at Charles de Gaulle.

Following the logic of the above, these airlines should be located at significantly lower points on their respective average cost curves, that is, closer to their minimum efficient scale, if we assume that they can avoid diseconomies from airport congestion.

The three shaded zones attempt to categorize European airlines according to their entry barriers with respect to economies of scale. Zone 1 depicts airlines that operate somewhere around the minimum efficient scale in the industry. Their unit costs are lower than those of their competitors because they serve longer distances and are able to exploit denser routes due to their hub-and-spoke structure. Airlines such as Lufthansa, British Airways and Air France might fit in here. Zone 2 consists of airlines that serve intercontinental routes - and might exploit the advantage of lower unit costs there - but do not have dominance on specific hubs. This means that their routes may tend to be less dense, and operating economies from centralization may be diminished as well. Airlines such as Lauda Air, Iberia, Virgin Atlantic and SAS may be located here. Former flag carriers, which still hold relatively the most airport slots but are not dominant anymore, would be located towards the lower part of Zone 2. Zone 3 shows airlines such as Ryanair, easyJet, Deutsche BA, and many others that do not serve intercontinental routes. The fact that they do not have any dominant positions at hub airports does not allow them to take advantage of the funnelling effect of hub-and-spoke operations. That is, they tend to serve their city pairs in a less dense manner. Theoretically, a fourth zone is conceivable: European airlines without any intercontinental routes, but with dominance at certain hubs. However, in reality, the only airlines that have obtained something like dominance on certain hubs are former flag carriers. All former flag carriers do have intercontinental routes in their network structure.

II.4 Implications for strategic behaviour

The implications for strategic behaviour can be derived by analogy with what has already been said for dynamic limit pricing: Hub concentration determines the locus of minimum efficient scale and average stage length determines the slope of such an average cost curve. As a consequence, for the years following deregulation, incumbents should maintain their hub dominance or even grow it, if possible. They should concentrate more city pairs on their hubs (without congesting the hubs' infrastructure) to funnel in sufficient traffic for high-density hub-to-hub routes and try to increase the percentage of intercontinental, long-distance routes within their network system. These measures would then act as a deterrent to new entrants for given city pairs. If entry were to occur on certain city pairs, the incumbent would maintain his output on the particular spoke and cut prices below the entrant's average costs.

But the entrant could also be tempted to enter not only on a single city pair but also network wide in order to duplicate the incumbent's efficiencies. Only with such large-scale entry could we expect incumbents to lower their outputs and to increase prices, in order to maximize profits. Such a significant scale would require dominance at a major airport. At the moment, there are several important European airports where incumbents dominate: Paris - Charles de Gaulle, London - Heathrow, and Frankfurt. With reference to Scherer and Ross (1990), such large-scale entry would lower prices significantly, if we assume unit elasticity for demand and incumbents maintaining output: If about 15% of an incumbent's traffic were to involve a hub, new entrants who entered the same hub at the same scale would roughly depress prices (for competing city pairs) by 15%. As a consequence, an entrant would prefer not to enter at such a scale, unless pre-entry price is more than 15% above the entrant's unit costs.

If an entrant had the possibility to "buy" himself into airport dominance, he could shorten the period in which he would incur losses before making profits, due to the same average unit costs as the incumbent. However, these adjustment costs appear as infinitely high, since airport slots are only selectively marketed (Civil Aviation Authority 1998, pp. 47) and both construction and extensions of airports are highly limited. The increasing returns (steeper slopes for unit costs with higher density) due to international routes within an airline's network are equally difficult to obtain for new entrants. Virgin Atlantic was able to exploit British-American bilateral transatlantic agreements, as did Lauda Air on the Austrian side. These agreements, however, do not apply to other intra-European entrants to the industry. Again, adjustment costs for these unit cost advantages would be infinitely high, mostly for bilateral trade and legal reasons. These factors make it very unlikely that entrants could replicate an incumbent's AC-curve and obtain the same structural conditions for operating at the same minimum efficient scale as the incumbent. The incumbent would anticipate entry at particular city pairs and limit price below the average unit costs of entrants, while maintaining capacity on those spokes to deter entry.

The question remains by how much the entrant is truly disadvantaged, given these factors, since entrants may exhibit firm-specific economies (for a comparison of actual unit costs, see Civil Aviation Authority 1998, p. 141).

II.5 Describing maintained output

The major research question of this thesis is how entry barriers influence the pricing and output decisions of airlines. This chapter has examined economies of scale. Specifically applied to the airline industry, maintaining output because of economies of scale would be reflected in:

Average aircraft size

If the incumbent switched to smaller planes, we could hardly assume this would deter entrants in the sense of dynamic limit pricing.

Average load factors

These are not only dependent on the incumbent's choice of capacity but also on demand. Although smaller aircraft with higher load factors could provide the same output as bigger albeit less loaded aircraft, the signal to the entrant would not be one of deterrence, but of accommodation on a particular city pair.

Average departures per airport

Another way of making capacity choices, which has already been mentioned (Kirby 1986), is to change the number of average departures per airport. One would assume that increasing flight frequency would maintain output, even when using smaller planes. This last parameter, however, is negatively related to the industry- specific economies of scale as outlined above. Average departures per airport takes an average flight frequency among all airports in a network, thus neglecting the density effect of hubs. Even when looking at the flight frequencies originating or feeding into a hub airport, we confirm a negative relationship with average aircraft size: For a given demand between two cities, an airline could employ one big aircraft (say a Boeing 757) with one daily connection. If it were to increase flight frequency to twice a day, or even three times a day, the company would need to switch to smaller carriers (say Boeing 737s) to keep the plane reasonably loaded. The argument of economies due to centralization of services at a hub does not apply for the average departures per port parameter either. Why should unit costs for passenger service, maintenance, etc. be lower if the airline were to send two smaller aircraft instead of one bigger? In short, only if we see average aircraft size for given city pairs staying constant or even increasing, can we confirm entry deterrence after deregulation along the lines of dynamic limit pricing (with the incumbent to be understood to lower prices below the entrant's average costs).

The following exploratory scatterplot provides a first perspective on part of what is to be tested for statistical significance in the empirical part of this paper. After examining 178 different cases involving 35 heavily travelled city pairs served by several airlines, our scatterplot suggests that the vast majority of airlines did not follow our reasoning derived from dynamic limit pricing and applied to the airline industry: Airlines, especially incumbents, preferred smaller aircraft to larger ones, and the trade-off between flight frequency and aircraft size most often was resolved in favour of increasing frequency.

In the period between 1993 and 1997, we see that flight frequencies of airlines for given city pairs increased - more so when the use of smaller aircraft was maintained or seat capacity was only slightly increased. The cluster around Manchester -Brussels with KLM will be disregarded, since it depicts cases where traffic was shut down after deregulation. The fact that this cluster appears on the upper boundary of increasing aircraft size is due to the computations involving the sum of squared errors, etc. thus eliminating negative signs. Instead of finding an indication for an increasing (or even a vertical) slope between changes in frequency and aircraft size, which would have supported the hypothesis of exploiting economies of scale, we find a clearly decreasing, almost horizontal, slope. The scatterplot does not provide empirical (though only exploratory) support for the hypothesis of operating at minimum efficient scale through hub dominance either: The suggested tendency to increase frequency on short-distance European city pairs, rather than using larger aircraft, will hardly lower average unit costs.